By Rick Elton, Managing Director of Sheshunoff & Co., Investment Banking

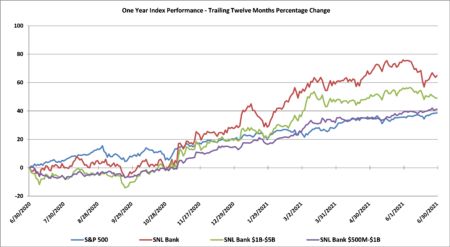

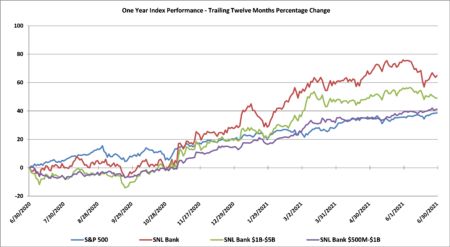

Powered by an economic recovery that many investors believe is still gathering pace, stocks closed out the first half of 2021 with year-to-date double-digit gains. The second quarter of 2021 marks the DJIA and the S&P 500 indexes’ fifth consecutive quarter of gains, their longest such streak since a nine-quarter stretch that lasted through 2017.

Even as stocks continue to move upward with subdued volatility, there is a growing anxiety that future gains will be tougher without some catalyst. In June alone, stocks logged both their worst week since October of last year and their best week since February of this year.

To some extent, the lack of direction for the market could be viewed as normal. Stocks are now in their second year of a bull market, after bouncing back from the pandemic-fueled selloff of early 2020. Going back to World War II, it has been fairly typical in the second year of a recovery for trading to be choppy and for stocks to register lower returns.

Financial stocks gave up some of their gains late in the quarter as investors viewed a recent pullback in the 10-year Treasury yield as reducing hope of potential short-term relief to their battered net interest margins as interest rates moved lower. The 10-year U.S. Treasury yield was around 1.7% at the end of the first quarter of 2021, falling to 1.44% at the end of the second quarter, but still up from the 0.9% at the start of the year. Although the 10-year Treasury yield has snapped back from the Covid-19 shutdown, the recent decline indicates longer-term economic growth might be more muted than investors expected just a few months ago. This is in part because of lower prospects for additional large stimulus packages from the U.S. federal government.

The SNL Bank Index posted a modest 3.7% rise during the second quarter of 2021 compared to the robust 23.6% rise in the first quarter of 2021 with the index now up by approximately 64.9% over the past year. This index is now up by 18.8% over the past three-year period. By comparison, smaller banks posted slightly better returns during the second quarter of 2021, with the SNL Bank $500 million to $1 billion index increasing by 7.2% after increasing by 13.9% during the first quarter of 2021 with the index being up by 41.2% over the past year while posting a three year rise of 12.9%. The SNL Bank $1 billion to $5 billion index increased by 1.7% during the second quarter of 2021 after posting a 20.8% rise during the first quarter of 2021 leaving it up by 49.0% over the past year and still down by 2.0% over the past three years. By comparison, the S&P 500 was up by approximately 8.2% during the second quarter of 2021 after increasing by 5.8% during the first quarter of 2021 and is now up by 38.6% over the past year. The S&P 500 was up by approximately 58.1% during the past three-year period compared to the 18.8% rise for the SNL Bank Index and the 93.1% increase in the technology-heavy Nasdaq.