By: David Etter – Managing Director Bennington Partners/SCS

Section 4013 of the Cares Act

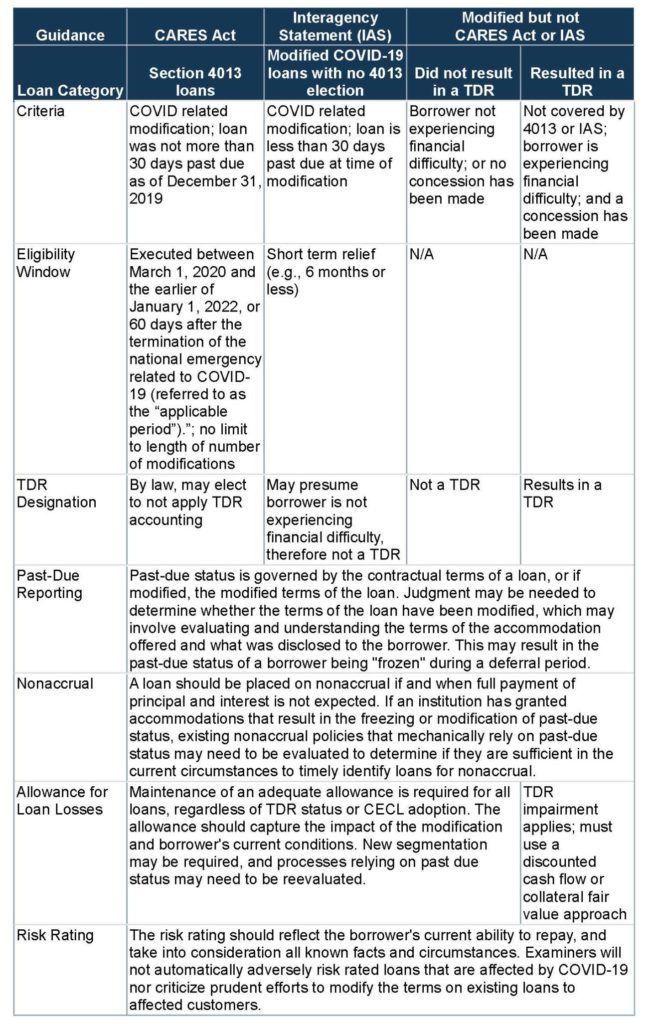

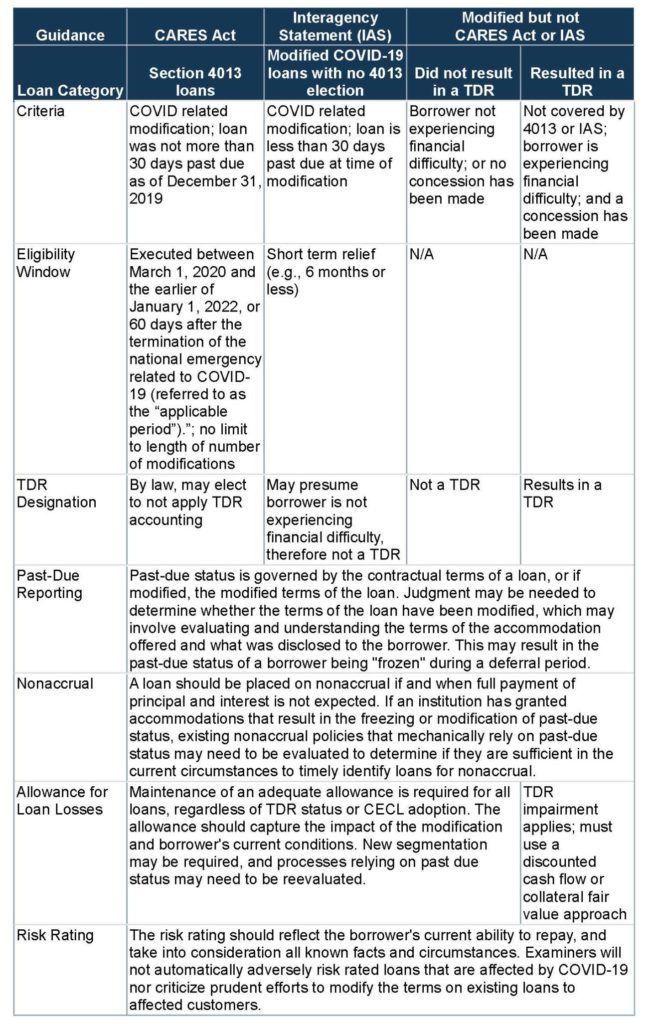

The most relevant benefit for Commercial Loan portfolios was the ability to grant COVID related modifications without having to burden the modified loan with a TDR designation for the remaining life of the loan. This benefit was scheduled to end the earlier of December 31, 2020 or the 60th day after the end of the COVID-19 national emergency declared by the President.

Section 541 of the Consolidated Appropriations Act, 2021

Extends the above benefit to December 31, 2021. The other existing rules still apply: the loan must have been current on contractual payments as of December 31, 2019.

COVID Deferrals

When COVID Deferrals first stated, many institutions were offering 3 or 6 months of deferral, interest only or full P&I deferral. Once the fall came, and the economic environment had not recovered, we started seeing the need for additional deferrals. Institutions were providing another 6 months of deferrals for a total of 12 months. This quickly evolved into Institutions offering deferrals totaling 18 months, full P&I deferrals.

The premise of the modifications within the Interagency Guidance of the Regulatory Guidance from April 2020 is that the need for payment relief is “short-term.” “Short-Term” was parenthetically defined by the Regulators as not to exceed 6 months.

There had been very little regulatory guidance on the length of deferrals since the fall. On December 4, 2020, the Federal Reserve published COVID-19 Supervisory and Regulatory FAQ’s. Included therein was the following question and answer:

Does a loan modification need to be “short-term” in duration to be eligible for relief under section 4013? For example, could a loan modification that defers payment for 18 months be eligible under section 4013? Updated 02/16/2021

A: A loan modification does not need to be “short-term” to be eligible under section 4013 of the CARES Act. Section 4013 does not restrict the term or length of loan modifications, as long as the modification meets the requirements of section 4013. To be eligible under section 4013, a loan modification must be (1) related to COVID-19; (2) executed on a loan that was not more than 30 days past due as of December 31, 2019; and (3) executed between March 1, 2020, and and the earlier of January 1, 2022, or 60 days after the termination of the national emergency related to COVID-19 (referred to as the “applicable period”).”

A loan modification that defers payment for 18 months would be eligible if the above criteria are met.